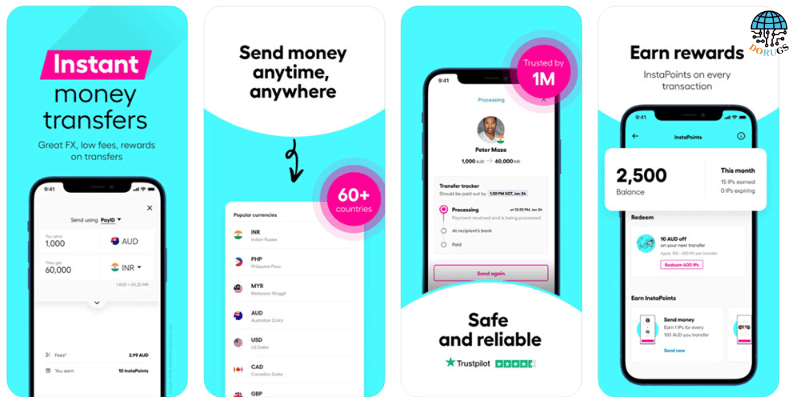

In an increasingly interconnected world, the ability to send money internationally with ease and transparency is more important than ever. Instarem has emerged as a leading money transfer platform, renowned for its low fees, competitive exchange rates, and user-friendly interface. But one common question remains: “Where can you send money with Instarem?” In this comprehensive guide, we’ll explore the range of countries supported by Instarem, detail which countries you can send from and to, explain transaction limits across different regions, discuss available payout methods, and highlight key considerations when transferring money to certain countries.

Drawing from insights provided by top review websites around the globe, we’ve compiled this in-depth analysis to help you understand Instarem’s global reach and empower you to make smart international transfer decisions.

Table of Contents

ToggleA Global Network: Instarem’s Supported Countries

Instarem is dedicated to making international money transfers accessible and affordable. With a focus on providing transparency and low-cost transactions, Instarem operates in a wide range of countries. This global network means that many users can benefit from its services regardless of their location.

Supported Sending Countries

Instarem primarily targets markets where digital money transfers are in high demand. Among the countries where you can register and send money from are:

- North America: United States, Canada

- Europe: United Kingdom, Germany, France, Italy, Spain, Netherlands, and other major European nations

- Asia-Pacific: Australia, Singapore, Hong Kong, India, Malaysia, and others

- Middle East: UAE, Saudi Arabia, and neighboring countries

- Latin America: Selected countries where digital remittances are on the rise

These regions represent a significant share of the global remittance market. Instarem’s services are designed to cater to the needs of expatriates, freelancers, small businesses, and everyday individuals who need to transfer funds quickly and securely.

Supported Receiving Countries

Instarem’s network isn’t just about where you can send money from—it also focuses on where your recipient can receive funds. Supported receiving countries include:

- North America & Europe: Many Western countries are supported, allowing for smooth transactions between major financial hubs.

- Asia: Instarem covers a broad array of Asian countries, such as India, China, the Philippines, Vietnam, and more. This is particularly beneficial for immigrants and overseas workers sending money home.

- Africa: In select African nations, Instarem facilitates direct bank deposits and mobile money transfers, supporting the continent’s growing digital financial landscape.

- Latin America & Caribbean: Instarem is expanding its network to include key countries in these regions, recognizing the increasing demand for fast, affordable remittances.

- Oceania: In addition to Australia, several Pacific island nations benefit from Instarem’s services.

The platform is continuously expanding its list of supported countries as it grows its global footprint. Whether you’re sending money to a major financial center or a developing economy, Instarem strives to provide reliable service and transparency.

Transaction Limits Based on Different Regions

While Instarem offers an impressive global network, it’s important to note that transaction limits can vary based on the country you’re sending from or to. These limits are designed to comply with regulatory requirements and to ensure a secure transfer environment.

Typical Transaction Limits

- Low to Moderate Transfers: For personal remittances, you might typically be able to send amounts ranging from a few hundred dollars up to several thousand dollars. This range is designed to cater to everyday users who need to support family or pay for overseas services.

- Higher Transaction Limits: For business or high-value transfers, Instarem may offer higher limits. These limits are often negotiated on a case-by-case basis or set higher for verified business accounts.

- Regional Variations: Regulatory environments differ by country. In some regions, especially where anti-money laundering (AML) regulations are strict, the maximum transfer amounts may be lower. Conversely, in financial hubs like the UK or Singapore, higher limits are often available.

How to Check Your Specific Limit

To know the exact transaction limit for your country or currency corridor, it’s best to log into your Instarem account or consult their FAQ section. Instarem’s transparent pricing and policy pages are regularly updated, ensuring that you have access to the most accurate and current information.

Tip: If you plan on sending large amounts, consider contacting Instarem’s customer support for guidance. They may offer temporary increases or customized solutions to accommodate your needs.

Available Payout Methods for Different Countries

Instarem’s flexibility in payout methods is one of its biggest advantages. The platform adapts its services to meet the unique financial infrastructures of different countries. Here’s an overview of the various payout methods available across regions:

Direct Bank Deposits

- How It Works: The most common method is a direct bank deposit. The funds are sent directly to the recipient’s bank account.

- Where It’s Available: This service is widely available in countries with well-established banking systems, including the US, UK, most of Europe, and many parts of Asia.

- Benefits: Direct bank deposits are secure, typically incur low fees, and eliminate the need for the recipient to visit a physical location to collect the money.

Cash Pick-Up

- How It Works: For countries where not everyone has access to a bank account, Instarem partners with local banks or money transfer agents to offer cash pick-up services.

- Where It’s Available: This method is particularly common in parts of Asia, Africa, and Latin America.

- Benefits: Cash pick-up is convenient for recipients without bank accounts. It’s fast, and the process is straightforward, allowing recipients to collect funds in person.

Mobile Wallets

- How It Works: In regions where mobile money is prevalent, Instarem allows funds to be transferred directly into mobile wallets.

- Where It’s Available: Mobile wallet options are popular in Africa (e.g., M-Pesa in Kenya), parts of Asia, and Latin America.

- Benefits: Mobile wallets offer instant access to funds, low fees, and a high level of convenience, particularly for tech-savvy users.

Other Methods

- Alternative Payment Methods: In some countries, Instarem may offer additional payout options, such as local payment systems that are unique to the region.

- Multi-Currency Accounts: For recipients who frequently receive international payments, Instarem may support multi-currency accounts, allowing them to hold and convert funds at competitive rates.

Tip: When initiating a transfer, always check the available payout methods for the recipient’s country. This ensures that you select the option that offers the best combination of speed, cost, and convenience.

Important Considerations When Sending Money to Specific Countries

While Instarem makes international transfers simple and cost-effective, there are several important considerations to keep in mind when sending money to different countries.

Regulatory Requirements and Compliance

- Know Your Customer (KYC): Different countries have varying KYC and anti-money laundering (AML) regulations. Ensure that you provide accurate information and required documents to avoid delays.

- Local Regulations: Some countries have strict regulations on the amount of money that can be received from abroad. Familiarize yourself with these limits to ensure your transfer complies with local laws.

- Tax Implications: Depending on the country and the amount sent, there might be tax implications for the recipient. It’s wise to consult local financial guidelines if you’re sending large sums.

Currency Volatility and Exchange Rates

- Market Fluctuations: Exchange rates can fluctuate throughout the day. Instarem’s real-time transparency means you can see the current rate before you confirm a transfer, but it’s important to be aware of market volatility.

- Best Time to Transfer: If your recipient relies on the full value of the transfer, consider timing your transaction when the exchange rate is more favorable. Some users even set alerts for their preferred rates.

Payout Method Limitations

- Banking Infrastructure: In countries with less developed banking systems, the available payout methods might be limited. Cash pick-up and mobile wallets are often the only options.

- Accessibility: Consider the recipient’s ability to access the chosen payout method. For example, if a recipient doesn’t have a bank account, opting for direct bank deposit isn’t practical.

- Service Availability: While Instarem continuously expands its network, some remote or less developed regions might not yet be supported. Always verify that both the sending and receiving countries are included in Instarem’s network.

Transaction Limits and Fees

- Understanding Limits: Be aware of the transaction limits imposed in your currency corridor. These limits are there to comply with regulatory standards and might affect larger transfers.

- Total Cost: When calculating the total cost of your transfer, consider both the transaction fee and any exchange rate markups. Even a small percentage difference in exchange rates can significantly impact the final amount received.

Customer Support and Troubleshooting

- Support Channels: Instarem provides robust customer support to assist with any issues that may arise during a transfer. Whether you need help with registration or encounter a delay in your payout, support is available via chat, email, or phone.

- Time Zones and Local Holidays: Be mindful that processing times may be affected by local holidays or differences in time zones. Plan your transfer accordingly if time is of the essence.

- Feedback and Reviews: Reading user reviews and feedback can provide insight into any recurring issues with transfers to specific countries. Top review sites often share these details, so a little research beforehand can save you time later.

Instarem’s commitment to transparency, competitive fees, and a broad network of supported countries makes it an excellent choice for international money transfers. Whether you’re sending money to family, paying for overseas services, or handling business transactions, knowing where Instarem operates is key to unlocking its full potential.

Key Takeaways:

- Global Coverage: Instarem supports a wide range of sending and receiving countries across North America, Europe, Asia-Pacific, the Middle East, Africa, and Latin America.

- Flexible Payout Methods: From direct bank deposits and cash pick-up to mobile wallets, Instarem offers payout options tailored to the recipient’s needs.

- Clear Transaction Limits: Understand the regulatory requirements and transaction limits for your currency corridor to avoid any hiccups.

- Important Considerations: Always verify local regulations, check the available payout methods, and be mindful of exchange rate fluctuations to maximize the value of your transfer.

Ready to see if your country is supported?

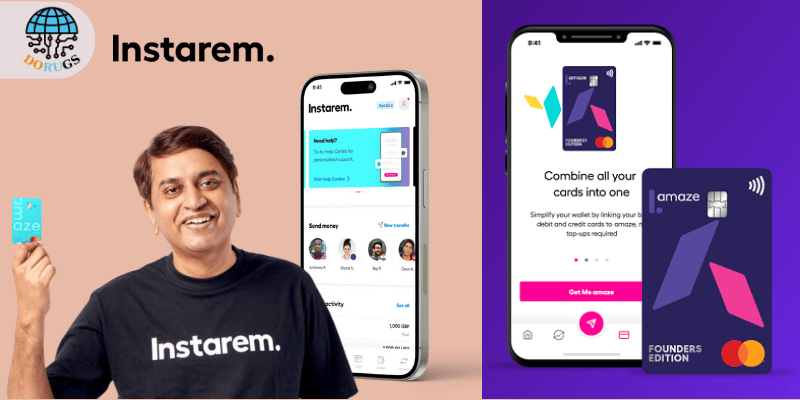

Take the next step toward hassle-free international money transfers with Instarem. Check your country’s availability, review the payout methods, and explore how low fees and competitive exchange rates can save you money on every transaction.

Join thousands of satisfied users who trust Instarem for their global financial needs. Whether you’re sending money to loved ones abroad or managing cross-border business payments, Instarem offers a reliable and cost-effective solution tailored for today’s global economy.

Don’t wait any longer – register with Instarem today!

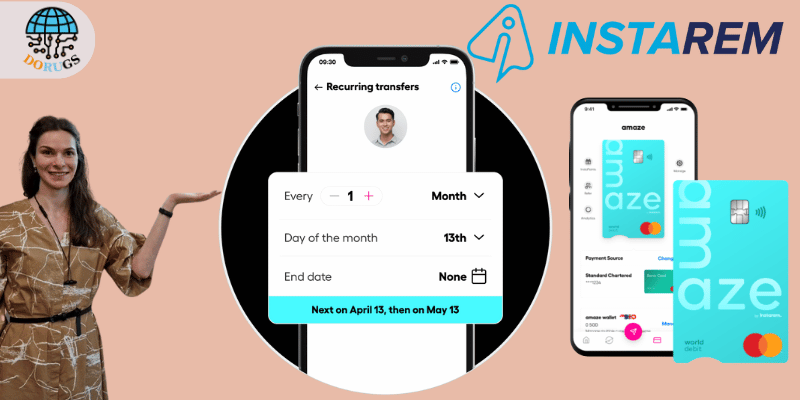

Visit the Instarem website or download the Instarem mobile app now to start transferring money effortlessly. With Instarem, enjoy a transparent, user-friendly platform that puts you in control of your international transactions.

Final Thoughts

In this guide, we’ve explored the extensive list of countries supported by Instarem, along with important details about sending and receiving funds, transaction limits, and available payout methods. Instarem’s broad global network and flexible payment options ensure that no matter where you are or where your recipient is located, you have a powerful tool to manage your international money transfers.

By choosing Instarem, you not only benefit from competitive fees and great exchange rates but also from a system designed with transparency and user convenience in mind. Take advantage of the growing network, clear pricing, and efficient processing times to transform how you handle international transfers.

Ready to make your international money transfers simpler and more affordable?

Visit the Instarem website today, verify your country’s support, and join the community of global users who have already embraced this innovative service. Start transferring money with confidence and enjoy all the benefits of a truly global money transfer solution.

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel