Sending money abroad has never been easier, but choosing the right service can save you a lot of time and money. Instarem, Wise (formerly TransferWise), PayPal, and Remitly are four popular international money transfer services, each with its own strengths. In this comprehensive guide, we compare these providers across key factors – transaction fees, exchange rates, transfer speed, and usability – to help you decide which option fits your needs. We’ll draw on recent data, user reviews, and official sources for accuracy. Read on for a detailed breakdown and, by the end, you’ll be equipped to choose the best service for your international transfer needs.

Table of Contents

ToggleTransaction Fees Comparison

One of the first things to consider is how much each transfer will cost. Fees can include flat transaction charges or a percentage of the amount sent, and they vary by provider. Here’s how Instarem, Wise, PayPal, and Remitly stack up on fees:

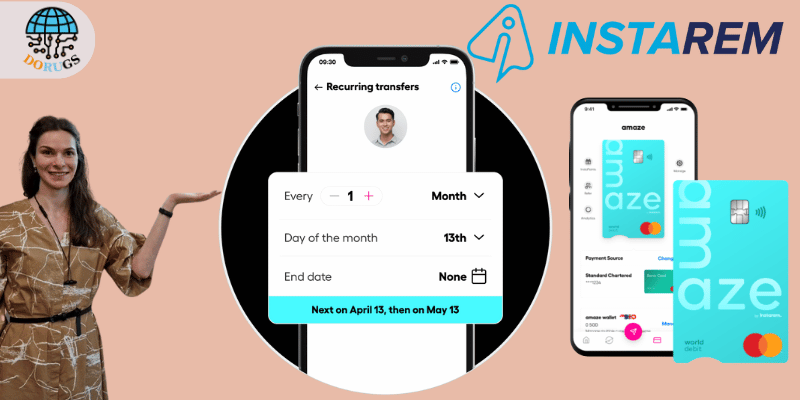

- Instarem: Known for low-cost transfers, Instarem typically charges a small percentage fee (around 0.25% to 1% of the transfer amount) with no hidden markup on the exchange rate. On many popular routes, Instarem may even offer no transfer fee promotions, making it very affordable. By keeping fees low, Instarem aims to undercut traditional banks and even many competitors. (Do note that fees can vary by currency corridor, but overall Instarem is designed to be cost-effective for personal and business transfers.)

- Wise: Wise uses a transparent fee structure with a low upfront fee that often comes out to about 0.3–0.6% of the amount (the exact fee has a fixed portion plus a small percentage). This is far cheaper than the fees charged by conventional services – for example, Wise’s total fees are much lower than PayPal’s ~5% charge for a similar transfer. All fees are shown upfront before you send, so there are no surprises. Wise’s transparency and low fees are frequently praised by users and are a big part of why many consider it the cheapest option for international transfers.

- PayPal: PayPal’s fees for international transfers are relatively high and can be confusing. For personal international payments, PayPal charges what it calls a “cross-border fee” which might be around 4.99% of the amount plus a fixed fee (about $0.49 USD) per transfer. These fees vary by country and payment method, and do not include the currency conversion costs (PayPal’s exchange rates have their own markup, discussed below). In some cases, PayPal’s fee might be lower for small transfers (e.g. a few dollars on small amounts), but once you factor in exchange rates, PayPal often ends up more expensive overall for sending money abroad.

- Remitly: Remitly’s fee structure depends on the service speed and sending amount. For economy transfers (slower delivery) funded from a bank account, Remitly often charges no upfront fee if you send above a certain threshold (for example, no fee on transfers over $500). Smaller amounts or Express transfers (which arrive faster or when paying by credit/debit card) may incur a flat fee, typically a few dollars. However, Remitly, like many remittance services, makes money through the exchange rate – they add a markup (0.5% to 3% on the currency rate) instead of charging large fees. In summary, Remitly’s visible fees are low (even $0), but you should consider the exchange rate markup to gauge the true cost.

Tip: Always consider both the transfer fee and the exchange rate offered. A provider with zero fees might give you a poor exchange rate to compensate. In the next section, we’ll compare the exchange rates and markups of Instarem, Wise, PayPal, and Remitly.

Exchange Rates and Currency Markups

Exchange rates can significantly impact how much your recipient gets. The “mid-market” rate (also called interbank rate) is the real exchange rate you see on Google or Reuters, and some services use it while others add a markup. Here’s what to expect from each provider’s exchange rates:

- Instarem: Instarem offers very competitive exchange rates. The company advertises no hidden markup on their rates, effectively giving rates close to the mid-market rate. In practice, Instarem’s rates do include a small margin in some corridors, but this is usually minimal, and they compensate with low transfer fees. For example, in a direct comparison, Instarem’s exchange rate might be only slightly lower than the real market rate (a tiny difference that could amount to a fraction of a percent). This transparent approach means you generally get a good rate, and when combined with their low fees, the overall cost remains low.

- Wise: Wise always uses the mid-market exchange rate with no markup. This is a core feature of Wise – you get the exact real exchange rate, and Wise just charges its fee separately. The benefit is you know you’re not losing money on an inflated rate. Wise even allows you to lock in the rate for short periods (typically 24–48 hours) for some transfers, ensuring transparency. This policy of no exchange-rate margin is a major reason Wise is often the cheapest option; you only pay the low transfer fee and nothing more. In terms of fairness and transparency, Wise leads the pack on exchange rates.

- PayPal: PayPal, on the other hand, is known for adding a significant markup on currency conversions. According to PayPal’s disclosures, the exchange rate you get includes a currency conversion fee typically around 3.5%–4% above the mid-market rate. For example, converting from GBP to USD via PayPal might include ~3.75% markup, and GBP to AUD around 4%

. This means if the true rate is 1 GBP = 1.30 USD, PayPal might give you around 1.25 USD. That difference goes to PayPal. Combined with PayPal’s transaction fees, this markup makes it one of the most expensive ways to send money internationally. PayPal is upfront about these conversion fees in their terms, but it’s easy to overlook since they simply show you the rate you get. Always check the rate they offer against the market rate – you’ll often find PayPal “hidden fees” in that difference. - Remitly: Remitly also applies a markup on exchange rates, though it varies by currency corridor. The markup ranges from about 0.5% up to 3% over the mid-market rate. In many popular routes (sending from the US to India, Philippines, etc.), the markup might hover around 1-2%. Remitly promotes “no hidden fees,” meaning they make the exchange rate and any margins clear to the user before completing the transfer. Still, this margin means your recipient gets a bit less than they would at the pure market rate. For instance, if you’re sending USD to INR, and the real rate is 1 USD = 82 INR, Remitly might give something like 1 USD = 80 INR (the difference being their cut). The trade-off is that Remitly’s upfront fees are low; this model is common for remittance-focused services. Overall, Remitly’s exchange rates are competitive in the remittance industry, but not as exact as Wise’s mid-market rate.

Key takeaway: Wise offers the best exchange rates (no markup at all), while Instarem and Remitly provide competitive rates with small markups. PayPal’s exchange rates are the least favorable, often significantly lower than the market rate, which can greatly affect large transfers. Always compare the “recipient gets” amount across services – sometimes a provider with a fee can still yield more money delivered, if their rate is better.

Transfer Speed

How fast will your money reach the recipient? Transfer speed can range from minutes to several days, depending on the service and how you fund the transfer. Here’s a comparison of speed for Instarem, Wise, PayPal, and Remitly:

- Instarem: Transfers with Instarem usually arrive within 1–2 business days

. Instarem does not typically offer instant transfers; instead, they focus on low-cost ACH or bank-to-bank movements, which take a day or two to clear. The exact timing can depend on the route and receiving bank – some users report transfers arriving the next day, while others may wait up to 48 hours. If speed isn’t an absolute priority (for example, sending routine remittances or business payments a couple of days in advance), Instarem’s timeline is generally reliable. However, for urgent, within-the-hour transfers, Instarem might not be the fastest option. - Wise: Wise is known for its fast transfers. In fact, about 40% of Wise transfers arrive instantly, and roughly 80% arrive within 24 hours. Many transfers (especially between major currency pairs) are completed within minutes

. Wise achieves this speed by using a smart system of local bank networks – often your money doesn’t physically cross borders, Wise pays out from their local account in the destination country. That said, transfer speed can still vary: if you pay by a slower method like a bank debit (ACH) it might take 1-2 days, whereas paying by credit/debit card or using a balance can speed it up. Overall, Wise tends to be one of the fastest services, especially for common corridors, and they give an estimated delivery time upfront so you know what to expect.

- PayPal: PayPal transfers can be instant in certain scenarios, but slow in others. If you are sending money from your PayPal balance to another person’s PayPal balance, the transfer is essentially instant – the recipient sees the money in their PayPal account right away. This makes PayPal convenient for sending money to friends/family who also use PayPal. However, if the recipient needs to move the money out of PayPal into a bank account, that withdrawal can take a few days (typically 1–3 business days for the bank transfer). Also, if you’re funding the payment by pulling money from your bank (instead of an existing PayPal balance or card), it may take 3–5 days before PayPal releases the money to the other side. In summary, PayPal is fast wallet-to-wallet, but not instantaneous for bank transfers. It’s best when both sender and receiver keep the money within PayPal’s system.

- Remitly: Remitly offers two delivery options, giving you a choice between speed and cost:

- Express: The Express service delivers money within minutes to the recipient, even enabling near-instant cash pickup or bank deposit in many cases. This is ideal for emergencies. To use Express, you typically must pay with a debit or credit card, which incurs a higher fee or card charge. Essentially, you’re paying a bit extra for speed

- Economy: The Economy option is the low-cost route, often fee-free or minimal fee, but it takes about 3–5 business days for the money to arrive

. Economy transfers are funded via bank account (ACH), hence the slower timeline due to bank processing. This option is great if cost savings are more important than speed and the transfer isn’t urgent.

With these two options, Remitly lets users decide what matters more for each transfer – time or money. In both cases, Remitly provides an estimated delivery date and even a delivery guarantee (or your fees back) for many corridors.

In summary: Wise generally provides the fastest transfers for bank-to-bank payments in most countries (often within hours), while Remitly’s Express option can be just as fast or faster for certain corridors if you’re willing to pay by card. Instarem is moderately quick (1-2 days, which is still faster than a typical bank wire). PayPal can be instant, but only within its own network – getting money to a bank via PayPal will take a bit longer. Consider how urgent your transfer is: if it’s an emergency, you might lean towards Wise or Remitly’s express; if it’s routine, any of these (aside from PayPal’s extra steps) will do the job in a few days or less.

Usability and User Experience for Different Users

Beyond fees and speed, consider how easy the service is to use and what features it offers for your particular needs. “Usability” covers the interface, customer support, and how well the service caters to various user groups (individuals, businesses, immigrants sending money home, online shoppers, etc.). Let’s look at each provider:

- Instarem: Ease of use: Instarem is an entirely digital platform with a clean mobile app and website, making it straightforward to send money. You sign up online, verify your ID, and you can start transferring in minutes. Payments made through Instarem go directly to the recipient’s bank account (Instarem doesn’t hold funds in wallets)

, which simplifies things for recipients – they don’t need to take extra steps; the money just arrives in their bank. Instarem focuses on cross-border transfers and doesn’t try to do too much else, which means the experience is streamlined for that purpose. User group suitability: Instarem is great for individual senders who want low costs and are comfortable using an app/website. It’s also used by small businesses to pay international suppliers or remote freelancers, thanks to its competitive rates. However, Instarem’s coverage is somewhat limited – you can sign up from around 30-36 countries and send to about 55+ countries

. This covers major markets (US, UK, Europe, India, Australia, etc.), but not every country worldwide. For those who can use it, Instarem gets high marks for customer satisfaction (Trustpilot rating around 4.5 out of 5 from thousands of reviews)

, with users praising its low fees and reliable service. Additionally, Instarem offers a rewards program (InstaPoints) where you earn points on transfers that can be redeemed for fee discounts

– a nice perk for frequent users. Overall, if you’re in a supported region and value cost above all, Instarem’s user experience is tailored for quick, low-cost remittances with little hassle. - Wise: Ease of use: Wise is often lauded for its intuitive interface and transparency. Signing up and making a transfer with Wise is very straightforward – the platform will show you a detailed breakdown of fees and the exact exchange rate before you send, and even an estimate of when the money will arrive. Wise supports transfers to 80+ countries and in 50+ currencies, and it also offers some extras like being able to schedule transfers or repeat transfers easily. The Wise mobile app is highly rated for its smooth user experience. Features for different users: Wise shines for a variety of use cases. For expats and travelers, Wise provides a multi-currency account (formerly known as Wise Borderless) that lets you hold balances in many currencies and even get local bank details (like an IBAN, routing number, etc.) in about 10 currencies

. This is incredibly useful if you need to receive payments internationally or spend money abroad. They also offer a debit MasterCard linked to your account, so you can spend from any currency balance at the real exchange rate. For businesses and freelancers, Wise allows international invoicing and batch payments, and because of the low fees, it’s popular for paying overseas contractors. Wise’s user base is huge (10+ million customers), and its Trustpilot reviews are excellent (about 4.6 out of 5 from over 150k reviewers)

– users frequently mention the ease of use, speed, and cost savings as reasons they love it

. One limitation is that Wise is purely digital – there are no physical branches and no cash pickup options

. So it’s best for users who have a bank account on the receiving end. In terms of customer support, Wise offers help via email and an option for phone support in some regions, but support hours may be limited (since they cater to a global audience). Overall, Wise provides a modern, user-friendly experience ideal for tech-savvy individuals, frequent cross-border users, and businesses that need to move money globally with minimal fees.

- PayPal: Ease of use: PayPal’s strength is its ubiquity and familiarity. Most people find PayPal easy to use for online payments – you log in with an email and password, and you can send money to someone using their email address or mobile number. For domestic use and online shopping, PayPal is very convenient. For international transfers, the experience is a bit different: you’re still essentially just making a payment to another PayPal account, but if the recipient doesn’t have an account, they’ll be prompted to create one. The user interface hasn’t changed much in years – it’s functional, if not the most modern. PayPal does integrate with a lot of other apps and websites, so sending money can sometimes be done from within other platforms (for example, Facebook, or an invoice system might have “Pay with PayPal”). User group suitability: PayPal is often used by freelancers and online businesses to send or receive payments, because it’s a common denominator globally and also offers buyer/seller protection for commercial transactions. It’s also used casually among friends/family internationally if both sides already use PayPal. However, when it comes to pure money transfer purposes, PayPal’s user experience has some downsides. For one, both sender and receiver need PayPal accounts for a seamless transfer; getting money out of PayPal (to your bank) is an extra step that some find annoying

– and that step can incur fees or wait times. Additionally, account security and customer support can be pain points: PayPal has been known to freeze accounts if they suspect unusual activity, and resolving such issues can be frustrating. This is reflected in user reviews – PayPal has a very low Trustpilot rating (~1.3 out of 5) with many complaints

, though keep in mind this includes all of PayPal’s services (not just international transfers). On the positive side, PayPal does have features others don’t: you can link credit cards, get credit from PayPal, and use their platform to pay for goods/services worldwide. It’s also available in 200+ countries (the widest reach of these four) and supports 25 currencies

. In summary, PayPal is highly usable if both parties are already in the PayPal ecosystem, but for a one-off international remittance, it’s less straightforward and more costly. It caters well to e-commerce and people who prioritize convenience over cost, but if you’re purely looking to send money abroad cheaply and simply, PayPal’s user experience might not be as satisfying as the others.

- Remitly: Ease of use: Remitly is designed specifically for remittances – i.e., people sending money to family or friends in another country, often on a recurring basis. As such, its interface is simple and geared towards that use case. The mobile app and website guide you through selecting a country, entering an amount, and choosing delivery method (bank deposit, cash pickup, mobile wallet, etc.). Remitly’s onboarding is user-friendly; they even offer the website/app in multiple languages to accommodate users who may not be fluent in English

. One standout is the clarity in showing the two options (Express vs Economy) so you can choose speed vs fee easily. Remitly also provides a status tracker for your transfer and will notify both sender and receiver when money is available. User group suitability: Remitly focuses on the needs of immigrants and overseas workers sending money back home. For example, if you’re an Indian expat in the US sending money to India, or a Filipino worker in the UK sending money to the Philippines, Remitly is built for you. It supports delivery to 130+ receive countries, often with options like cash pickup at local banks or agents, home delivery (in some countries), or mobile money deposits. This makes it extremely accessible to the recipients, even if they don’t have a bank account. On the sender side, Remitly is available in about 28 countries to send from (primarily North America, Europe, and Asia-Pacific regions). Remitly does not cater to business transfers or merchant payments – it’s purely personal remittances. Users often praise Remitly’s customer service and even a “100% satisfaction guarantee” where they refund fees if something goes wrong. The company’s focus seems to be on trust and reliability, knowing people send money to loved ones for important needs. Customer reviews for Remitly are largely positive – it scores about 4.5 to 4.6 out of 5 on Trustpilot

, with customers highlighting the fast transfers, ease of use, and good exchange rates for major corridors. In short, Remitly’s user experience is optimized for repeat remittance senders: it’s easy, reassuring, and recipient-friendly. If you need to send money to someone who might want to pick up cash or if you value a service that understands migrant communities, Remitly is an excellent choice.

Choosing the Best Option for Your Needs (Conclusion)

Each of these four services excels in different areas, so the “best” choice really depends on your priorities and situation. Here’s a quick recap to help you decide:

- If low fees and great exchange rates are your top priority: Wise and Instarem come out on top. Both keep costs minimal, with Wise having the edge on exchange rates (mid-market with no markup)

. Instarem isn’t far behind, especially on major routes, and even rewards you for using it

. These two are ideal for budget-conscious users who want to maximize what their recipient gets. Wise also offers more currency support and multi-currency accounts, which might sway you if you deal in multiple currencies regularly. - If speed is critical: Wise and Remitly (Express) are your go-to options. Wise completes many transfers in minutes, and Remitly’s Express service can deliver cash or bank deposits almost instantly in many receiving countries

. If you have an emergency or your recipient needs money right now, consider these. Just remember Remitly Express may cost a bit more for that speed, whereas Wise is often fast without extra fees in popular corridors. - If you need cash pickup or your recipient isn’t tech-savvy: Remitly is specifically built for that scenario. Remitly’s network of banks and money pickup locations in destination countries is a huge advantage if the person you’re sending money to prefers to collect cash or doesn’t use online banking. PayPal and Wise do not offer cash pickup, and Instarem only offers it in a limited way (Philippines). So for sending money home to family in rural areas or places where bank access is limited, Remitly is likely the best option.

- If you and your recipient both use PayPal already: PayPal could be convenient, albeit at a cost. The transfer will be instant account-to-account, and it might feel easier to stick within one platform. This is common for freelancers getting paid by international clients or friends splitting bills across countries. However, be cautious – the convenience comes with higher fees and weaker rates. Unless you absolutely need to use PayPal, you’ll generally save a lot using Wise or Instarem for sending directly to a bank. PayPal might still make sense for small, infrequent transfers or where using a card/paypal balance is necessary for the transaction.

- For business transactions: Wise (with its Business account features) or PayPal (for e-commerce) might be considerations. Wise Business lets you invoice in different currencies and pay overseas employees with low fees, which can greatly benefit a small business. PayPal Business is more about accepting customer payments and doing commerce (and remember, PayPal also owns Xoom for remittances if needed). Instarem also offers business solutions for international payments, though without the merchant tools that PayPal has. Consider what your business needs – pure international payments favor Wise/Instarem, while online selling might lean toward PayPal for its integration and buyer protection.

In conclusion, all four services are trustworthy and secure, but they serve different needs:

- Wise is the best all-rounder for cost, speed, and multi-currency flexibility.

- Instarem is excellent for low-cost transfers if you’re in its supported regions, and it keeps things simple.

- Remitly is tailored for helping families receive money conveniently, with options tuned for the recipient’s ease.

- PayPal is ubiquitous and handy if everyone involved is already on PayPal, but it’s generally the priciest for currency transfers.

Now that you’ve compared Instarem, Wise, PayPal, and Remitly across fees, rates, speed, and usability, it’s time to choose the best fit for your needs. Think about what matters most to you – saving money on fees, getting money there fast, or perhaps a specific feature like cash pickup or multi-currency holding. Whichever service matches your priorities, taking action is simple: visit their website, sign up for an account, and start your transfer. Don’t let high fees or slow services eat into your funds; instead, pick the smart option that lets you send money internationally with confidence. Empower yourself by choosing the right service today, and enjoy peace of mind on all your future international money transfers!

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel