In today’s digital world, international money transfers are more accessible—and more transparent—than ever before. With platforms like Wise revolutionizing the way money moves across borders, understanding the cost behind each transaction is key to maximizing your savings. In this comprehensive guide, we dive deep into the Wise fee structure so you can see exactly what you’re paying for and why Wise stands out as a cost-effective alternative to traditional banks and other money transfer services.

Drawing insights from the top global review websites, this detailed analysis covers every aspect of Wise’s pricing—from upfront fees to exchange rates and hidden costs—ensuring that you have all the information you need to make smarter financial decisions.

International money transfers are an essential part of modern finance. Whether you’re sending remittances to family overseas, paying for education abroad, or settling international business invoices, the fees you pay can have a significant impact on the value of your transaction. This guide is designed to help you understand the Wise fee structure in detail—revealing how Wise manages to keep costs low while offering transparency, efficiency, and competitive exchange rates.

By breaking down each component of Wise’s pricing model, we aim to provide you with the insights needed to compare Wise with traditional banks and other online money transfer services. Ultimately, this knowledge empowers you to choose the best option for your financial needs.

Table of Contents

ToggleWhy Understanding the Fee Structure Matters

Before you make any international transfer, it’s crucial to understand how fees and exchange rates work together to determine the final amount your recipient gets. Here are a few reasons why a detailed understanding of the fee structure is important:

- Maximize Your Savings:

Every fee and markup can reduce the amount that reaches your recipient. Knowing the exact costs helps you minimize unnecessary expenses. - Transparency and Trust:

With traditional banks, hidden fees and poor exchange rates can catch you off guard. Wise’s transparent fee structure builds trust by ensuring you know exactly what you’re paying for. - Informed Decision-Making:

When you understand the fee breakdown, you can compare providers accurately and choose the one that offers the best value for your money. - Optimizing Transfer Strategies:

By knowing how fees are applied, you can plan your transfers more effectively, choosing the best times and methods to send money internationally.

This guide will provide you with all the information you need to get the most out of every transfer you make.

An Overview of Wise’s Fee Structure

Wise’s fee structure is built on three core principles: transparency, low costs, and the use of real mid-market exchange rates. Let’s break down each component.

Transparent Pricing

One of the primary reasons users choose Wise is its commitment to transparency. Unlike many traditional banks that bury fees in fine print, Wise makes all charges visible upfront.

- Clear Fee Display:

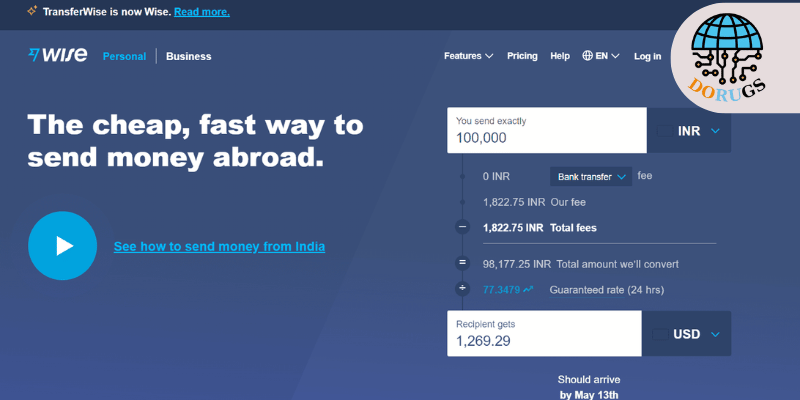

Before you confirm any transaction, Wise provides a detailed breakdown of the fees involved. This means no surprises—what you see is what you pay. - Real-Time Calculators:

Wise’s online fee calculator allows you to enter your transfer details and instantly see the fee breakdown. This tool ensures you know the exact cost before you proceed.

Transparency is key to building trust, and Wise has set a high standard by ensuring that every fee is clearly communicated.

Upfront Transfer Fees

Wise charges a small, upfront fee for processing your transfer. These fees can be either fixed or percentage-based, depending on the amount you’re sending and the currencies involved.

- Low, Competitive Fees:

For many transfers, the fee is significantly lower than what traditional banks charge. For example, sending $1,000 internationally might cost you as little as $10 with Wise, compared to $40–$50 with banks. - Simple Fee Model:

The fee structure is designed to be simple and understandable. There are no hidden fees that suddenly reduce the transferred amount after the fact.

This upfront fee model is one of the key advantages of using Wise. It ensures that you always know the cost of your transfer, and it keeps more of your money in your pocket.

Exchange Rates and Their Impact

A major part of the Wise fee structure is the use of the real mid-market exchange rate. This rate is the most accurate reflection of the current value of one currency compared to another.

- No Exchange Rate Markup:

Many providers, especially traditional banks, add a markup to the exchange rate, which can result in a significant loss over time. Wise, however, uses the true mid-market rate, ensuring that you get the best possible conversion. - Direct Financial Benefit:

By avoiding exchange rate markups, Wise ensures that you receive a higher amount in the destination currency. Even a small percentage difference can have a substantial impact, especially on larger transfers.

The combination of low transfer fees and the use of real exchange rates means that Wise consistently offers a superior financial advantage over traditional methods.

Comparing Wise’s Fees to Traditional Banks

Traditional banks have long been the standard for international transfers, but their fee structures are often complex and less favorable than those offered by Wise.

Fee Differences

- High Fixed Fees:

Banks typically charge higher fixed fees per transfer. For instance, a single international transfer may cost you $40–$50, regardless of the amount being sent. - Hidden Charges:

Beyond the visible fees, banks may include hidden charges such as intermediary fees and receiving fees that are not disclosed until after the transfer is complete. - Exchange Rate Markups:

Banks frequently apply a markup to the exchange rate, meaning you lose additional money on currency conversion. Even a 1-3% markup can lead to significant losses over time.

Why Wise Offers Better Value

- Lower, Transparent Fees:

With Wise, you pay a low, upfront fee that is clearly disclosed. There are no unexpected charges that reduce the overall value of your transfer. - Real Exchange Rates:

Wise’s commitment to using the true mid-market rate means that every transfer maximizes the recipient’s received amount. - Faster Processing Times:

Beyond cost savings, Wise’s efficient processing ensures that funds are delivered quickly—another factor that can be critical for many users.

When you compare these factors side by side, it becomes clear that Wise’s fee structure provides a more cost-effective solution for international money transfers.

How Additional Costs Affect Your Transfer

While the upfront fee and exchange rate are the main components, it’s important to consider how additional costs can affect your transfer.

Intermediary Fees

- What They Are:

Intermediary fees are charges applied by banks that facilitate the transfer between the sending and receiving banks. These fees can be unpredictable and vary depending on the route the money takes. - Impact on Traditional Transfers:

These additional fees can sometimes add up to 10-15% of the transfer amount, significantly reducing the funds received. - Wise’s Advantage:

Wise minimizes the impact of intermediary fees by operating with a digital-first model, ensuring that any such fees are kept to an absolute minimum or are completely avoided.

Processing Fees and Miscellaneous Charges

- Hidden Processing Fees:

Some transfer services include processing fees that are not immediately visible. These can erode the value of your transfer without your knowledge. - Wise’s Approach:

Wise’s transparent fee calculator displays all costs upfront, so you’re never surprised by additional deductions after the fact.

By eliminating or minimizing these extra charges, Wise ensures that you get the maximum value from each transfer.

Real-World Examples: Savings in Action

Let’s illustrate the financial benefits of Wise with some real-world scenarios.

Scenario 1: Sending Remittances

Imagine you are an expatriate sending $1,000 to your family overseas every month.

- Traditional Bank:

- Transfer Fee: $50

- Exchange Rate Markup: 2% below the mid-market rate

- Additional Intermediary Fees: $20

- Total Deductions: $70, leaving $930 for your family.

- Wise:

- Transfer Fee: $10

- Real Mid-Market Exchange Rate applied

- Minimal additional fees

- Total Deductions: $10, leaving $990 for your family.

Over the course of a year, these savings add up to nearly $720 extra delivered to your family—money that can make a real difference.

Scenario 2: Business Payments

A small business owner transfers $5,000 to an overseas supplier.

- Traditional Bank:

- High transfer fees and hidden costs could reduce the supplier’s payment by several hundred dollars.

- Wise:

- Lower fees and the true mid-market rate ensure that nearly the entire $5,000 is received.

These examples demonstrate how Wise’s transparent fee structure translates into tangible savings, whether you’re managing personal finances or running a business.

Best Practices for Optimizing Your Transfers

To maximize the benefits of Wise’s fee structure, consider these best practices:

- Monitor Exchange Rates:

Use rate alerts to transfer funds when the exchange rate is most favorable. - Plan Transfers Strategically:

If your transfer isn’t urgent, waiting for optimal market conditions can significantly increase the recipient’s amount. - Review Fee Details Regularly:

Familiarize yourself with Wise’s fee breakdown for each transaction so you always know what to expect. - Leverage Multi-Currency Accounts:

Holding funds in multiple currencies can help you avoid unnecessary conversion fees. - Stay Informed:

Follow Wise’s blog and subscribe to their newsletter for the latest updates on fees, promotions, and new features.

By implementing these strategies, you can ensure that every international transfer delivers maximum value.

Customer Experiences and Industry Insights

User reviews and expert insights from the top global review websites consistently highlight the benefits of Wise’s fee structure:

- Cost Savings:

Many users report significant savings compared to traditional banks, thanks to lower fees and the real mid-market exchange rate. - Transparency:

Customers appreciate the clear, upfront breakdown of fees, which eliminates surprises and builds trust. - Efficiency:

Faster processing times combined with lower costs result in a better overall experience.

These factors are often cited as key reasons why users choose Wise over more expensive and opaque traditional banking options.

Are you ready to experience the real value in your international money transfers? With Wise’s transparent fee structure, you can save money, avoid hidden charges, and ensure that more of your funds reach their intended destination.

Take Action Today!

Visit Wise now and sign up for an account. Discover for yourself how Wise’s low fees, real mid-market exchange rates, and innovative digital tools can transform the way you send money internationally. Whether you’re sending remittances, managing business payments, or simply looking for a better way to transfer funds, Wise offers the efficiency and transparency you need to maximize every dollar.

Join millions of users who have already made the switch to a smarter, more cost-effective way of transferring money. Optimize your financial transactions and enjoy peace of mind knowing that you’re getting the best value possible.

Conclusion

This detailed analysis has broken down the Wise fee structure and compared it to the traditional banking model. By offering a transparent fee model, charging low upfront costs, and using the real mid-market exchange rate, Wise provides a financial advantage that can save you significant money over time. Whether you’re an individual sending remittances or a business managing international payments, understanding these differences is crucial.

The savings from lower fees and better exchange rates translate into more money reaching your recipient and a more efficient transfer process overall. With no hidden charges and a commitment to transparency, Wise stands out as the clear choice for modern, international money transfers.

Thank you for reading our comprehensive guide on how Wise’s fees compare to traditional banks. For more expert insights, tips, and updates on optimizing your international money transfers, be sure to subscribe to our blog and follow us on social media.

Ready to transform your money transfer experience?

Visit Wise today, sign up, and start enjoying a transparent, cost-effective, and efficient way to send money across borders. Your journey to smarter, more efficient international transfers begins now!

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

With a range of options—from digital-first platforms to traditional remittance...

In today’s fast-paced global economy, frequent international money transfers have...

Sending money abroad has never been easier, but choosing the...