In today’s interconnected financial landscape, sending money internationally is more important than ever. With the rise of digital financial services, consumers have increasingly turned to platforms like Wise to save money on international transfers. But how do Wise’s fees compare to those charged by traditional banks? In this comprehensive guide, we’ll break down the differences in cost, transparency, and overall value between Wise and conventional banking services. Drawing on insights from the top 10 global review websites, this detailed analysis will help you understand why Wise is a game changer when it comes to international money transfers.

International money transfers are essential for individuals and businesses alike, whether you’re sending remittances to family, paying tuition fees, or managing cross-border business transactions. However, the cost of transferring money can vary significantly depending on the service provider. Traditional banks have long dominated the market, but their fees, hidden charges, and unfavorable exchange rates often leave customers with less than what they expect.

Enter Wise—a fintech innovator known for its transparent pricing, low fees, and real mid-market exchange rates. In this article, we perform a detailed Wise fees vs banks comparison, shedding light on why many savvy users are switching from traditional banks to Wise for their international money transfers. Our analysis covers fee structures, exchange rates, processing times, and additional costs, ensuring you have all the information you need to make an informed decision.

Table of Contents

ToggleThe Landscape of International Money Transfers

Before diving into the specifics of fee comparison, it’s important to understand the overall landscape of international money transfers.

Traditional Banks

Traditional banks have been the cornerstone of international money transfers for decades. They offer reliability and widespread trust, backed by extensive regulatory oversight. However, they also come with significant drawbacks:

- High Transfer Fees: Banks typically charge a fixed fee for international transfers, which can range from $40 to $50 or more per transaction.

- Hidden Costs: In addition to the visible fees, banks often impose additional charges, such as intermediary fees and receiving fees, which aren’t always disclosed upfront.

- Unfavorable Exchange Rates: Banks usually offer exchange rates that are marked up by 1-3% above the mid-market rate, meaning you lose extra money during the conversion process.

- Slow Processing Times: International transfers via banks can take several business days, sometimes delaying critical transactions.

Digital-First Platforms Like Wise

Digital financial services, such as Wise, have disrupted the traditional model by offering a more customer-centric approach. Their benefits include:

- Transparent Pricing: Wise clearly displays all fees before you complete your transfer—no hidden charges.

- Real Exchange Rates: Wise uses the true mid-market rate, so you get more of your money in the recipient’s currency.

- Lower Fees: Due to their streamlined operations and digital-first approach, Wise can charge significantly lower fees.

- Faster Processing: Many transfers with Wise are processed in a fraction of the time required by traditional banks.

This evolving landscape is the foundation for our in-depth analysis of Wise fees vs banks.

Understanding Fee Structures: Wise vs. Traditional Banks

A major part of the cost associated with international money transfers comes from the fee structures of the service providers. Let’s break down the differences between Wise and traditional banks.

Wise’s Transparent Fee Model

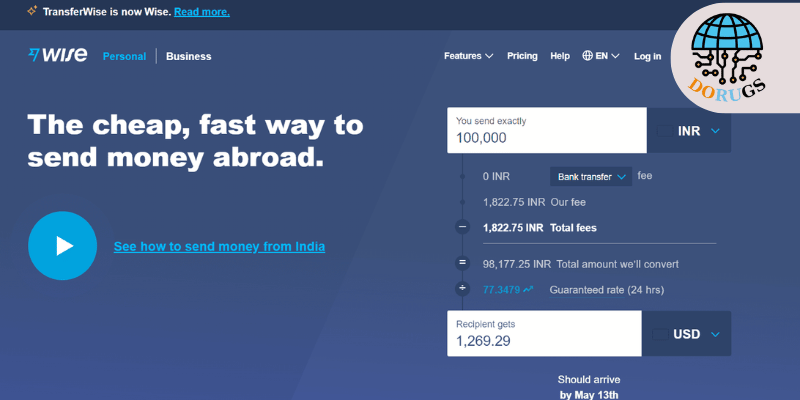

Wise has built its reputation on transparency. When you initiate a transfer with Wise, you’re provided with a complete breakdown of the costs, including:

- Upfront Transfer Fee:

Wise charges a clear, low fee that is either a fixed amount or a small percentage of the transfer amount. For instance, for a $1,000 transfer, the fee might be as low as $10, compared to much higher fees from banks. - No Hidden Charges:

Unlike traditional banks, Wise does not tack on additional fees behind the scenes. Every charge is visible before you confirm the transaction. - Real-Time Fee Calculator:

Wise offers an online calculator that lets you see exactly what you will pay and what your recipient will receive. This tool ensures that you have full control over your finances.

This transparent approach not only builds trust but also helps users understand exactly how much money is being deducted from their transfers.

Traditional Banks and Hidden Costs

Traditional banks often have complex fee structures that can significantly reduce the value of your transfer:

- High Fixed Fees:

Many banks charge a flat fee that is considerably higher than Wise’s fee. For instance, a bank might charge $45–$50 for a single international transfer. - Intermediary Fees:

When transferring money internationally, traditional banks may use intermediary banks to process the transfer. Each intermediary can impose its own fee, further eroding the amount that reaches the recipient. - Exchange Rate Markups:

In addition to fixed fees, banks typically offer exchange rates that include a hidden markup—often between 1-3% above the mid-market rate. While this might seem small on paper, it can significantly impact large transfers. - Opaque Pricing:

Bank fee structures are often not fully disclosed upfront, leaving customers surprised by additional charges after the transaction is complete.

The cumulative effect of these hidden costs makes traditional banks less attractive compared to digital solutions like Wise.

Exchange Rates: The Heart of Money Transfers

Exchange rates are a critical component of international transfers. Even minor differences in rates can result in significant savings or losses.

The Mid-Market Rate Advantage

Wise stands out by offering the true mid-market exchange rate—the rate you see on financial news channels and forex platforms. Here’s why this matters:

- No Hidden Markups:

Traditional banks usually add a markup to the mid-market rate. For example, if the mid-market rate for USD to EUR is 0.90, a bank might offer 0.87, effectively costing you 3.3% more. - Maximized Recipient Value:

With Wise, your recipient gets the full value of your transfer, as no extra margin is applied to the conversion.

Real-World Impact of Exchange Rate Differences

To illustrate, imagine you’re transferring $1,000:

- At the Mid-Market Rate (0.90):

Your recipient receives €900. - With a Bank’s Markup (0.87):

Your recipient receives €870.

This €30 difference per $1,000 can add up quickly, especially if you’re making multiple transfers over time. Wise’s commitment to the mid-market rate directly translates to more money in your recipient’s account, enhancing overall value.

Real-World Cost Comparison: A Detailed Analysis

Let’s examine a detailed cost comparison between Wise and traditional banks using a hypothetical scenario.

Scenario: Transferring $1,000 Internationally

Traditional Bank Transfer

- Transfer Fee: Approximately $45

- Exchange Rate: Marked up by 1.5% (e.g., 0.87 instead of 0.90)

- Additional Fees: Possible intermediary fees of up to $20

- Total Cost: ~$65–$70 in fees, resulting in a reduced amount for the recipient

Wise Transfer

- Transfer Fee: Approximately $10

- Exchange Rate: Real mid-market rate (0.90)

- Additional Fees: Minimal to none

- Total Cost: ~$10, with the recipient receiving almost the full converted amount

Financial Impact

Over the course of multiple transactions or higher transfer amounts, these differences can result in substantial savings. For example:

- Monthly Transfers:

If you transfer $1,000 monthly, switching from a bank to Wise could save you over $600 per year. - Large Transfers:

For transfers of $10,000 or more, the savings become even more pronounced, with Wise offering a significantly higher amount to the recipient due to the real exchange rate.

This detailed Wise fees vs banks comparison underscores why Wise is increasingly becoming the preferred choice for international money transfers.

Additional Considerations Beyond Cost

While cost is a crucial factor, it’s important to consider other elements that affect the overall value of your transfer service.

Security and Trust

- Regulatory Compliance:

Wise is regulated by leading financial authorities, ensuring that your funds are secure. - Data Protection:

Advanced encryption and fraud prevention measures help safeguard your personal and financial information. - Customer Support:

Reliable customer support is essential, and Wise consistently receives positive reviews for its responsiveness and clarity.

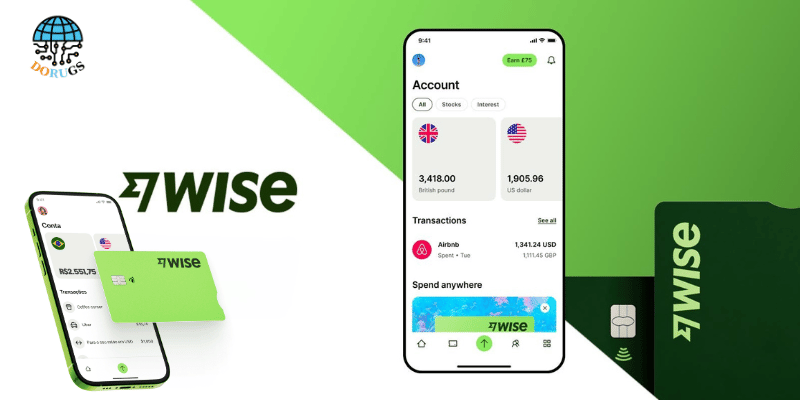

Convenience and Efficiency

- User Experience:

Wise’s platform is designed to be user-friendly, whether you’re using the web interface or mobile app. - Processing Times:

Faster transfer times mean that your funds reach their destination quickly, which is critical for urgent payments. - Global Reach:

Wise supports a wide range of currencies and countries, making it versatile for both personal and business needs.

Transparency

Transparency in fees and exchange rates builds trust and allows you to make informed decisions. Wise’s commitment to clear, upfront pricing is a major advantage over traditional banks, where hidden fees can often be a source of frustration.

These additional factors, when combined with the financial benefits, make a compelling case for choosing Wise over traditional banking options.

Customer Experiences and Industry Insights

User reviews and expert analyses from top review websites consistently highlight the following about Wise:

- Cost Efficiency:

Many users praise Wise for its low fees and superior exchange rates, noting significant savings compared to traditional banks. - Transparency:

The clarity of Wise’s pricing and fee breakdown is frequently cited as a major advantage. - Speed:

Faster processing times are a common theme in user testimonials, with many noting that Wise outperforms banks in delivering funds promptly. - Ease of Use:

The intuitive interface of both the web platform and mobile app makes Wise a favorite among users of all ages and tech-savviness.

These insights confirm that a Wise fees vs banks comparison isn’t just about numbers—it’s about overall user satisfaction and trust in the service.

Best Practices for Optimizing Your Money Transfers

To get the most out of your international money transfers, consider these best practices:

- Monitor Exchange Rates:

Use tools and alerts to transfer funds when the exchange rate is most favorable. - Plan Your Transfers:

If the transfer isn’t urgent, waiting for optimal conditions can maximize the value of your money. - Review Fee Details:

Always check the fee breakdown before confirming a transfer. Wise’s transparent model makes this easy. - Use Multi-Currency Accounts:

Holding funds in different currencies can help avoid frequent conversion fees. - Stay Informed:

Keep up with updates from Wise and financial news to adjust your transfer strategy accordingly.

Implementing these strategies can help you continuously optimize your transfers and achieve maximum financial efficiency.

Are you ready to take control of your international money transfers and maximize the value of every dollar you send? The detailed Wise fees vs banks comparison clearly shows that Wise offers superior transparency, lower fees, and better exchange rates than traditional banks.

Take Action Today!

Visit Wise now and sign up for an account. Experience firsthand how Wise can help you save money and streamline your international transfers. Whether you’re an expat, freelancer, small business owner, or someone who frequently sends remittances, Wise provides the tools and value you need to optimize your financial transactions. Join millions of users who have already made the switch to a smarter, more cost-effective way of sending money abroad.

Conclusion

In this comprehensive analysis, we’ve examined how Wise compares to traditional banks when it comes to fees and overall value. The Wise fees vs banks comparison reveals that Wise’s transparent pricing, real mid-market exchange rates, and low-cost operations translate into significant savings for users. These financial benefits, coupled with a user-friendly interface, robust security, and fast processing times, make Wise a standout option for international money transfers.

Choosing Wise means you’re not only saving money on each transaction but also ensuring that your funds are transferred quickly and securely. By implementing best practices such as monitoring exchange rates, planning your transfers strategically, and reviewing fee details regularly, you can further enhance the value you receive from every transfer.

Thank you for reading our detailed cost comparison. For more expert insights, practical tips, and the latest updates in international money transfers, be sure to subscribe to our blog and follow us on social media. Empower yourself with the knowledge to make smarter financial decisions and keep more money in your pocket.

Ready to revolutionize your international transfers?

Visit Wise today, sign up, and discover the financial advantages of a transparent, cost-effective money transfer service. Your journey to smarter, more efficient international transfers starts now!

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

With a range of options—from digital-first platforms to traditional remittance...

In today’s fast-paced global economy, frequent international money transfers have...

Sending money abroad has never been easier, but choosing the...