In today’s fast-evolving global financial landscape, maximizing the value of your money is more important than ever. Whether you’re sending remittances, paying for education abroad, or managing international business transactions, the platform you choose for money transfers can have a significant impact on the amount received. Wise has emerged as a leader in the field by offering transparent fees, real mid-market exchange rates, and innovative features—all of which translate into substantial financial benefits for users. In this in-depth financial analysis, we explore how Wise delivers superior Wise money value and why it stands out as the best option for international transfers.

The way we transfer money internationally has been revolutionized by fintech innovators like Wise. Gone are the days when hidden fees, opaque exchange rates, and lengthy processing times were the norm. Today, Wise offers a solution that not only saves you money but also empowers you with complete transparency and control over your transfers. This article provides a comprehensive financial analysis of Wise, demonstrating how its platform helps you get more for every dollar you send. Our focus is on delivering practical insights and actionable tips to help you maximize your Wise money value.

Table of Contents

ToggleThe Evolution of International Money Transfers

Historically, international money transfers were dominated by traditional banks, which often charged high fees and offered exchange rates that were far from competitive. These institutions typically added hidden markups, leaving customers with significantly less value upon conversion. The emergence of online money transfer services disrupted this model by introducing transparency, reduced fees, and better exchange rates.

Wise has been at the forefront of this transformation. By leveraging cutting-edge technology and focusing on customer-centric design, Wise redefines what it means to get the best financial value when transferring money internationally. Its approach is grounded in three core principles: transparency, efficiency, and cost-effectiveness.

Understanding Wise’s Value Proposition

Transparent Pricing

One of the most significant factors that contribute to Wise money value is its transparent pricing model. Unlike traditional banks that often hide fees in fine print, Wise clearly displays all costs upfront. This means you know exactly what you’re paying for before you initiate a transfer.

- No Hidden Fees:

Every fee is clearly itemized, ensuring that you can compare the total cost of your transfer without any surprises. - Upfront Fee Calculation:

Wise’s fee calculator provides a detailed breakdown, including the flat fee and any percentage-based charges, so you know exactly how much you’re saving compared to traditional methods.

Real Mid-Market Exchange Rates

At the heart of Wise’s value proposition is its commitment to offering the real mid-market exchange rate. This rate is the true reflection of currency values, unaffected by the markups commonly added by banks.

- No Exchange Rate Markup:

By using the mid-market rate, Wise ensures that you get the maximum value out of your conversion. Even a small difference in exchange rates can have a significant impact, especially on large transactions. - Transparency in Conversion:

Customers can see the exact rate being applied, which builds trust and helps you make informed decisions about when to transfer money.

Low-Cost Structure

Wise’s streamlined business model allows it to maintain a low-cost structure. With fewer overheads compared to traditional banks, Wise passes these savings directly on to its customers.

- Competitive Fees:

Low and transparent fees mean more money goes to your recipient instead of being lost to processing charges. - Efficient Operations:

Advanced technology and automation reduce operational costs, contributing to overall savings on each transaction.

These elements collectively form the backbone of the superior Wise money value that sets Wise apart from its competitors.

Financial Analysis: Getting More for Your Money

Let’s break down the financial benefits that Wise offers by comparing its costs and exchange rates with those of traditional banks and other competitors.

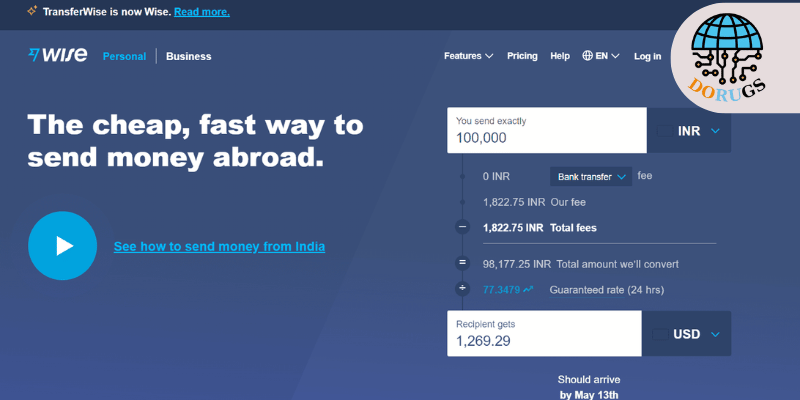

Cost Comparison with Traditional Banks

Traditional banks are notorious for their high fees and hidden charges. Consider a scenario where you transfer $1,000 internationally:

- Traditional Bank:

- Transfer Fee: $45

- Exchange Rate Markup: Approximately 1.5% worse than the mid-market rate

- Additional Charges: Up to $20 in intermediary fees

- Total Deductions: Can result in a loss of around $65 or more, reducing the final amount significantly.

- Wise:

- Transfer Fee: Approximately $10

- Exchange Rate: Real mid-market rate with zero hidden markups

- Additional Charges: Minimal to none

- Total Deductions: Often less than $10, meaning the recipient gets a far larger share of the original amount.

This direct comparison clearly illustrates how Wise delivers greater value by significantly reducing the overall cost of transferring money.

Savings Through Better Exchange Rates

Exchange rate differences, though seemingly small, can add up quickly. Suppose the mid-market rate for USD to EUR is 0.90. A traditional bank might offer 0.87, resulting in a 3.3% loss per transfer.

- Impact on $1,000 Transfer:

- At 0.90: Recipient gets €900

- At 0.87: Recipient gets €870

- Difference: €30 loss per $1,000 transferred

Over multiple transactions or larger amounts, these savings become substantial. Wise’s adherence to the mid-market rate ensures you never pay extra for a currency conversion, directly translating into more money in the recipient’s hand.

Impact on High-Volume Transfers

For businesses or individuals who send frequent or high-volume transfers, the savings multiply. A reduction in fees and a better exchange rate can lead to significant cumulative savings over time.

- Example:

A business transferring $10,000 monthly internationally could save hundreds of dollars each month compared to using traditional banks. This not only improves cash flow but also enhances profitability.

Wise’s model is particularly beneficial for those who regularly engage in international transactions, making it a smart financial decision over the long term.

Case Studies and Real-World Examples

Case Study 1: Family Remittances

Maria, an expatriate working in the UK, sends money to her family in India every month. By switching to Wise, she experiences:

- A reduction in fees from around $40 to less than $10 per transfer.

- Improved exchange rates, ensuring her family receives more in local currency.

- The ability to track transfers in real time, giving her peace of mind.

Over the course of a year, these savings add up, significantly easing the financial burden on her family.

Case Study 2: Small Business Payments

John runs a small import business in Australia and relies on international transfers to pay suppliers overseas. With Wise:

- He consolidates multiple payments into one monthly batch transfer, reducing fees.

- He benefits from the real exchange rate, ensuring that his suppliers receive the full value of the payment.

- Enhanced tracking and reporting tools help him manage cash flow more efficiently.

John’s business experiences a reduction in overall transfer costs by 15%, directly contributing to improved profit margins.

Case Study 3: Freelance Income Management

A freelance graphic designer based in the US receives payments from clients in various countries. Switching to Wise means:

- Lower transfer fees on incoming payments.

- Faster processing times, improving cash flow.

- Transparent conversion rates that ensure maximum income conversion.

By utilizing Wise, the freelancer not only maximizes his earnings but also saves time and minimizes administrative hassle.

Additional Features That Enhance Financial Value

Beyond the core benefits of lower fees and better exchange rates, Wise offers additional features that further enhance Wise money value.

Multi-Currency Account Benefits

- Seamless Currency Management:

Hold and manage funds in multiple currencies without frequent conversions. - Direct Payments in Local Currency:

Receive payments in the recipient’s local currency, reducing conversion losses and processing delays.

Batch Transfers for Businesses

- Efficiency and Cost Savings:

Consolidate multiple transfers to reduce the impact of fixed fees. - Improved Cash Flow Management:

Streamline payments to suppliers and employees, ensuring timely transactions and reduced administrative overhead.

Mobile App Efficiency

- Real-Time Notifications:

Stay updated on transfer statuses with instant alerts. - User-Friendly Interface:

The mobile app offers an intuitive way to manage transfers, check historical data, and receive support on the go.

These features not only contribute to the overall cost savings but also add convenience, making Wise an ideal choice for users seeking both financial and operational efficiency.

Best Practices for Maximizing Your Savings

To further enhance the financial benefits offered by Wise, consider adopting these best practices:

- Regularly Monitor Exchange Rates:

Use rate alerts to transfer funds when the exchange rate is most favorable. - Plan Your Transfers:

If the transfer isn’t urgent, wait for optimal market conditions. - Review Your Transaction History:

Analyze past transfers to identify patterns and adjust your strategy accordingly. - Stay Informed:

Follow Wise’s blog and subscribe to newsletters to keep up-to-date with the latest features and promotions. - Utilize the Multi-Currency Account:

Hold funds in multiple currencies to avoid unnecessary conversion fees.

Implementing these strategies ensures you continuously get the best value from every transaction.

Are you ready to maximize the value of every dollar you send? With Wise, you gain access to a platform that not only offers transparent pricing and the real mid-market exchange rate but also provides innovative tools to enhance your financial efficiency.

Take Action Today!

Visit Wise and sign up to experience firsthand how you can get more for your money. Whether you’re an expat, freelancer, or small business owner, Wise offers the tools and benefits you need to optimize your international transfers. Join the millions of satisfied users who have already discovered the smarter way to transfer money globally—maximize your savings, streamline your transactions, and empower your financial future with Wise.

This comprehensive financial analysis has shown how Wise helps you get more for your money by delivering superior value through transparent pricing, real mid-market exchange rates, and a low-cost structure. With features like a multi-currency account, batch transfers, and a user-friendly mobile app, Wise stands out as the optimal solution for anyone looking to enhance the efficiency and effectiveness of international money transfers.

By comparing Wise’s offering with traditional banking methods, it’s clear that the savings and convenience are unparalleled. Implementing the best practices discussed in this guide—such as monitoring exchange rates, planning transfers strategically, and taking advantage of innovative features—will further ensure that you maximize your Wise money value.

Thank you for reading our in-depth analysis on how Wise helps you get more for your money. For more expert insights, tips, and updates on international money transfers, be sure to subscribe to our blog and follow us on social media. Empower yourself with the knowledge to make every transfer count.

Ready to transform your international money transfers?

Visit Wise today, sign up, and discover the financial benefits of a truly transparent and cost-effective money transfer service. Start optimizing your transfers now and experience the difference that Wise can make for your global finances!

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

With a range of options—from digital-first platforms to traditional remittance...

In today’s fast-paced global economy, frequent international money transfers have...

Sending money abroad has never been easier, but choosing the...