In today’s globalized world, sending money across borders should be simple, affordable, and stress-free. If you’re wondering how to transfer money with Instarem, you’re in the right place. Instarem has quickly become a favorite for international money transfers, thanks to its transparent pricing, competitive exchange rates, and user-friendly platform. This comprehensive guide will walk you through every step of the process, ensuring that even first-time users can send money confidently and efficiently.

Whether you’re supporting family overseas, paying for education abroad, or handling business transactions, Instarem makes transferring money internationally easy. Let’s dive into the step-by-step process and explore how Instarem simplifies every stage of your money transfer.

Table of Contents

ToggleWhy Choose Instarem for International Transfers?

Before we jump into the step-by-step guide, let’s take a moment to understand why Instarem stands out among other international money transfer services.

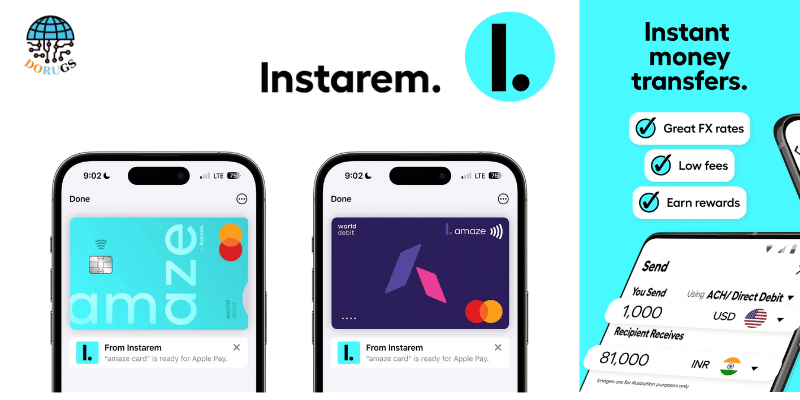

- Low Fees: Instarem is known for its competitive fees, which are often much lower than those charged by traditional banks and many other money transfer services.

- Competitive Exchange Rates: You get exchange rates that are close to the interbank rate, meaning more money reaches your recipient.

- Fast Processing: Instarem’s advanced technology ensures that most transactions are completed within 24 to 48 hours.

- Transparency: Every fee and exchange rate is shown upfront, so you’re never caught off guard by hidden charges.

- Security: With strict regulatory compliance and advanced encryption, your funds and personal data are well protected.

These benefits make Instarem an excellent choice for anyone who needs to send money internationally. Now, let’s get started with our step-by-step guide.

Step 1: Getting Started – Registration and Account Setup

1.1 Visit the Instarem Website or Download the App

The first step is to create an account with Instarem. You can do this by:

- Visiting the Website: Open your browser and go to Instarem’s website.

- Downloading the App: Alternatively, download the Instarem mobile app from the Apple App Store or Google Play Store.

Both the website and mobile app are designed with a clean, intuitive interface that makes signing up a breeze.

1.2 Click on “Sign Up”

Once you’re on the homepage or in the app:

- Look for the prominent “Sign Up” button.

- Click or tap the button to start the registration process.

1.3 Enter Your Personal Information

You will be asked to provide some basic details. This usually includes:

- Email Address: Use an email that you check regularly, as it will be used for verification and updates.

- Full Name: Enter your name exactly as it appears on your official identification documents.

- Phone Number: Provide a valid phone number, which may be used for additional verification or notifications.

- Password: Choose a strong password that includes a mix of letters, numbers, and symbols.

Tip: Double-check your details for accuracy to avoid any delays in the verification process.

1.4 Agree to the Terms and Conditions

Before you complete your registration, you’ll need to agree to Instarem’s terms and conditions. It’s a good idea to read these carefully so you know your rights and responsibilities when using the service.

Step 2: Completing Identity Verification (KYC)

2.1 What is KYC?

KYC stands for “Know Your Customer,” a process required by financial institutions to verify the identity of their users. This step is crucial for ensuring security and compliance with international financial regulations.

2.2 Provide a Government-Issued ID

You will be prompted to upload a clear image or scan of a government-issued ID, such as:

- Passport

- Driver’s License

- National ID Card

Make sure that the document is current and that all information is clearly visible.

2.3 Upload Proof of Address

Next, you need to prove your residential address. Acceptable documents include:

- Utility Bill (dated within the last three months)

- Bank Statement

- Official Letter from a Government Agency

Ensure that the document shows your name and address clearly.

2.4 Additional Verification Steps

In some cases, Instarem may ask for a selfie or a short video to match your face with the ID provided. This extra step is designed to further secure your account and speed up the verification process.

Tip: Follow the on-screen instructions carefully. Clear, well-lit images and videos help speed up the verification process.

2.5 How Long Does Verification Take?

Typically, the verification process takes 24 to 48 hours, although it may take a bit longer during high-volume periods. If there are any issues, Instarem’s customer support will reach out to help resolve them.

Step 3: Linking Your Preferred Payment Method

Once your identity is verified, you’re ready to set up your payment options. This step is essential because it determines how you’ll fund your transfers.

3.1 Choose a Funding Method

Instarem supports various payment methods, including:

- Bank Transfers: This method usually offers the lowest fees, making it ideal for those who prefer cost-effective transfers.

- Credit or Debit Cards: For quicker transactions, you might opt for card payments, though these can sometimes incur slightly higher fees.

- Other Local Payment Options: Depending on your country, Instarem may also offer other payment options like e-wallets or local bank transfers.

3.2 Enter Payment Details

Fill in the required information for your chosen payment method. For bank transfers, you might need to provide your account number, sort code, or IBAN. For card payments, you will need the card number, expiry date, and CVV code.

3.3 Confirm and Save Your Payment Method

After entering your details:

- Review the information carefully.

- Confirm the details to link the payment method to your Instarem account.

- Instarem might conduct a small test transaction to ensure that your payment method is valid and active.

Tip: Make sure the payment method you choose is one you plan to use regularly to fund your transfers, as this will streamline future transactions.

Step 4: Initiating Your Money Transfer

Now that your account is set up and your payment method is linked, you’re ready to start transferring money internationally.

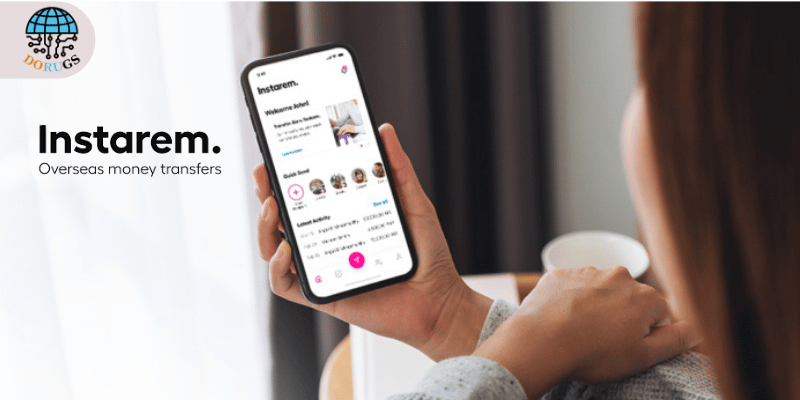

4.1 Log In to Your Account

Access your Instarem account via the website or mobile app. Ensure you are using a secure internet connection to protect your financial data.

4.2 Choose the Sending and Receiving Countries

- Select the Country You’re Sending From: This should automatically be pre-selected based on your account registration details.

- Select the Country You’re Sending To: Choose the destination country from Instarem’s supported list.

4.3 Enter the Amount You Wish to Transfer

- Input the amount in your local currency.

- Instarem will display the equivalent amount in the recipient’s currency, along with the applicable fees and exchange rate.

- Review the breakdown carefully to ensure you’re comfortable with the total cost of the transfer.

4.4 Review Transaction Details

Before confirming the transfer, make sure to:

- Check the Exchange Rate: Verify that the rate is competitive and transparent.

- Confirm the Fees: Ensure there are no hidden costs and that you understand the fee structure.

- Estimated Transfer Time: Note the expected time for the transfer to reach the recipient’s account.

4.5 Confirm and Authorize the Transfer

Once everything looks good:

- Click or tap the “Confirm Transfer” button.

- You might be asked to verify your identity again or enter a one-time password (OTP) for security.

- Upon confirmation, Instarem’s system will process your transfer automatically.

Step 5: Tracking Your Transfer

Transparency is a core principle at Instarem. Once your transfer is in process, you can track its progress in real time.

5.1 Access the Transaction Tracker

- Log in to your Instarem account.

- Navigate to the “Transaction History” or “Track Transfer” section.

- Each transaction will display its current status, from processing to completed.

5.2 Receive Notifications

Instarem sends updates via:

- Email: You’ll get notifications when your transfer is initiated, processed, and completed.

- SMS Alerts: For added convenience, you can opt to receive SMS notifications.

- App Push Notifications: If you’re using the mobile app, you’ll receive real-time alerts directly on your device.

Tip: Use these tracking features to plan ahead, especially if you’re relying on the funds to be available by a specific date.

Common Registration and Transfer Mistakes to Avoid

While Instarem’s process is designed to be user-friendly, a few common mistakes can delay your transfer. Here are some tips to help you avoid them:

6.1 Mistakes During Registration

- Incorrect Personal Information:

Ensure that all details you provide match your official documents. A small typo can cause delays in identity verification. - Poor-Quality Document Images:

Always upload clear, well-lit photos or scans of your ID and proof of address. Blurry images may be rejected, forcing you to re-submit and prolong the process. - Skipping Verification Steps:

Don’t try to bypass any part of the KYC process. Each step is there to protect you and ensure compliance with international regulations.

6.2 Mistakes During Money Transfer

- Not Reviewing Fees and Exchange Rates:

Always double-check the fee breakdown and exchange rate before confirming your transfer. Even a slight miscalculation can affect the final amount your recipient receives. - Choosing the Wrong Payout Method:

Make sure you select a payout method that suits the recipient’s needs. For example, if your recipient doesn’t have a bank account, opt for cash pickup or mobile wallet options. - Ignoring Transaction Limits:

Be aware of any transaction limits that apply to your transfer. If you plan on sending a large amount, verify that it falls within Instarem’s permitted range for your currency corridor.

Tip: If you’re ever in doubt, consult Instarem’s comprehensive FAQ section or reach out to their customer support for assistance.

Customer Support and Assistance

Should you encounter any issues during registration or while transferring money, Instarem offers robust customer support to help you along the way.

How to Reach Customer Support

- Live Chat:

Available on the Instarem website and mobile app for quick assistance. - Email Support:

Send your queries to Instarem’s support team, who typically respond within 24 hours. - Phone Support:

Some regions have dedicated phone support lines, ensuring that you can speak with a representative directly.

7.2 Utilizing the Help Center

Instarem also provides a detailed Help Center that covers:

- Troubleshooting common issues.

- Step-by-step guides for various processes.

- Answers to frequently asked questions.

Taking advantage of these resources can save you time and ensure a smooth transfer experience.

Transferring money internationally doesn’t have to be complicated or expensive. With Instarem, you gain access to a platform that prioritizes transparency, low fees, competitive exchange rates, and fast processing times—all wrapped up in an easy-to-use interface.

Here’s why you should choose Instarem:

- Cost-Effective: Say goodbye to high transfer fees and hidden charges.

- Transparent: Know exactly what you’re paying for with clear fee breakdowns and real-time exchange rates.

- Fast: Enjoy swift transfers that reach your recipient quickly, so you never miss a deadline.

- Secure: With strict security protocols and regulatory compliance, your funds and data are safe.

Ready to transform your international money transfers?

Take the first step today by signing up with Instarem. It’s quick, easy, and designed to make your financial life simpler. Whether you’re sending money to family, paying for services abroad, or managing business payments, Instarem provides a reliable and efficient solution tailored to your needs.

Join thousands of satisfied users who trust Instarem for their global transfers.

Visit the Instarem website or download the Instarem mobile app now and get started with your first transfer. Don’t let high fees and slow processing hold you back—experience the ease and transparency of Instarem today.

In Conclusion

This step-by-step guide has walked you through everything you need to know about transferring money internationally using Instarem. From setting up your account and verifying your identity to linking your payment method and tracking your transfer, every step is designed with simplicity and security in mind. By following these steps, you’ll be able to enjoy a seamless money transfer experience that saves you both time and money.

Remember, the key to a successful transfer lies in:

- Accurate registration and clear document uploads.

- Careful review of fees and exchange rates.

- Choosing the right payout method for your recipient.

Instarem empowers you to manage your international transactions with confidence and ease. With its user-friendly platform, competitive pricing, and robust customer support, Instarem is the smart choice for anyone looking to send money across borders.

Don’t wait any longer—take control of your global financial transactions.

Register with Instarem today and unlock exclusive benefits that make international money transfers effortless. Click the link below to start your journey towards a more efficient, transparent, and cost-effective way to send money:

Register with Instarem Now

About Me

Dorugs

Dorugsvn.com is a blog dedicated to providing valuable insights on business, technology, and gaming. We share in-depth articles, reviews, and guides to help readers stay informed and make better decisions in the digital world. Whether you’re exploring new tools, trends, or strategies, Dorugsvn.com is your go-to source for reliable and up-to-date information.

Related Posts

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel

Instagram Feed

- All Posts

- AI solutions

- AIArt

- Application

- Blog

- Book

- Business solutions

- Download PC

- Game

- VogueTech

- WildTech

- Back

- Novel